Introduction: The Silent Shift in American Wealth

For decades, wealthy Americans poured money into stocks, bonds, and real estate. But now, there’s a powerful new trend reshaping U.S. finance:

Rich investors are pumping record sums into private credit funds—a sector once seen as niche, now emerging as a mainstream alternative.

Private credit, once a corner of Wall Street, is becoming the go-to option for billionaires and family offices looking for high returns in uncertain times.

What Is Private Credit?

Private credit refers to loans made by non-bank institutions (like investment firms) to companies that don’t want—or can’t get—traditional bank financing.

- Instead of borrowing from a bank, companies borrow from private funds.

- Investors (wealthy individuals, pension funds, institutions) get steady interest payments in return.

Think of it as the “shadow banking system”—funding outside traditional banks, but increasingly important to global finance.

The Surge in Wealthy American Investments

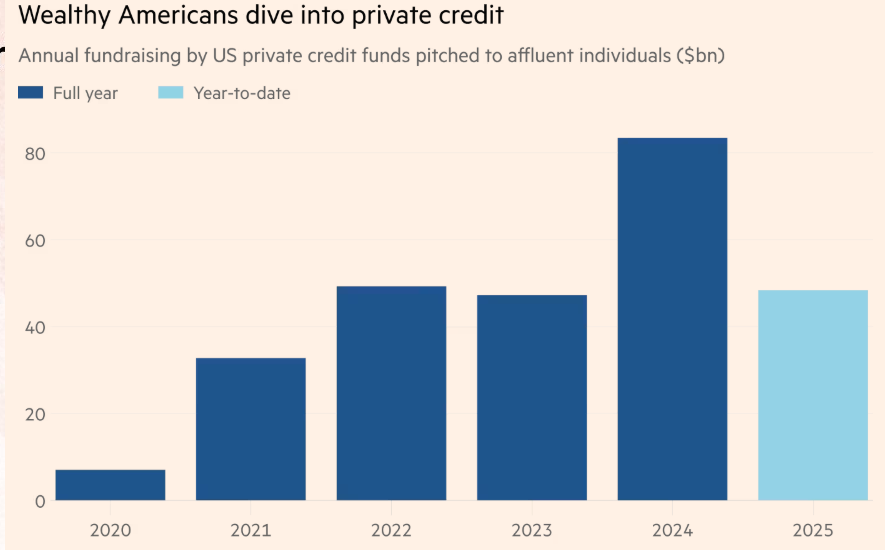

Record Inflows

- U.S. private credit funds have seen tens of billions of dollars in new investments in just the past year.

- Analysts estimate the industry could soon exceed $2.3 trillion globally, with the U.S. leading the charge.

Who’s Investing?

- Ultra-high-net-worth individuals

- Family offices

- Institutional investors like pension funds and endowments

Why the Rush?

- High yields: Private credit often offers returns of 8–12%, compared to 4–5% from traditional bonds.

- Diversification: Wealthy investors want to move beyond stocks and bonds.

- Resilience: In a world of inflation and volatile markets, private credit is seen as a steady income generator.

Why Now?

Several factors explain why private credit is booming:

- Bank Pullback

- After 2008 and recent banking stresses, traditional banks have tightened lending.

- Companies now turn to private funds for financing.

- High Interest Rates

- The Federal Reserve’s rate hikes make traditional borrowing expensive.

- Private credit steps in with flexible terms, attracting borrowers.

- Investor Demand for Alternatives

- Stocks are volatile, and bonds underperform.

- Wealthy investors see private credit as a middle ground—higher returns with manageable risk.

Benefits for Wealthy Investors

- Steady Cash Flow: Attractive for retirees and family offices seeking income.

- Customization: Deals can be tailored, unlike standardized bank loans.

- Direct Access: Wealthy investors feel they have more control over where their money goes.

Risks Lurking Beneath the Surface

Private credit isn’t a free lunch. Experts warn of potential dangers:

- Default Risk

- Borrowers are often companies that can’t secure traditional loans—meaning higher risk of failure.

- Liquidity Issues

- Unlike stocks, investors can’t just sell and exit. Funds are locked in for years.

- Lack of Transparency

- These markets aren’t as heavily regulated as banks, creating blind spots for investors.

- Economic Slowdown Threat

- If a recession hits, defaults could spike, leaving investors exposed.

How This Affects the Broader Economy

- Companies Benefit: Businesses that might struggle with bank loans now get funding to grow.

- Banks Lose Influence: Traditional banks are losing their monopoly on lending.

- Systemic Risk Concerns: Regulators worry that if private credit balloons too much, it could create a hidden financial bubble.

Example: The Rich Man’s “Bond Alternative”

Imagine a wealthy investor choosing between:

- A government bond with 4% returns.

- A private credit fund promising 10% returns.

The higher yield is tempting—like choosing a luxury car over a basic sedan. But with the upgrade comes more maintenance costs and risk of breakdown.

The Future of Private Credit

Experts predict:

- The sector will continue growing as banks stay cautious.

- Technology and fintech may make private credit more accessible beyond just the ultra-rich.

- Regulators will likely step in if the industry becomes too systemically important.

A Double-Edged Sword

Wealthy Americans are betting big on private credit funds, seeing them as a golden ticket to high returns in a shaky economy.

But like all shiny opportunities, private credit comes with risks—hidden defaults, liquidity traps, and regulatory uncertainty.

See this for more info:- https://www.ft.com/content/0b3cd961-f748-4c0b-8298-e9329820e244

Check Out Our Latest Blogs:-

- Vegetarian Diet: A Sustainable Path to Animal Welfare in India

- Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

- Genetic Engineering for Wildlife: Reviving Extinct Species in India

- Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

- Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Check Out Our More Content:-

Vegetarian Diet: A Sustainable Path to Animal Welfare in India

Vegetarian diet in India is renowned for its large vegetarian population, but meat consumption is…

Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

Supreme Court Verdict Brings Spotlight on Vantara and Vantara Government Project The Supreme Court of…

Genetic Engineering for Wildlife: Reviving Extinct Species in India

Introduction: The Promise of De-Extinction Imagine hearing a wolf’s howl never heard for 12,000 years….

Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

Introduction In August 2025, Punjab faced its most devastating floods in nearly four decades, as…

Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Introduction: The Silent Shift in American Wealth For decades, wealthy Americans poured money into stocks,…

India Blocks Azerbaijan’s Bid for Full Membership in the SCO: What It Means for Regional Politics

Introduction: A Diplomatic Roadblock The Shanghai Cooperation Organisation (SCO)—a powerful Eurasian political, economic, and security…