Introduction: A Surprising Economic Bright Spot

At a time when many global economies are struggling with inflation, rising debt, and sluggish growth, Turkey has emerged with a surprise headline:

The Turkish economy grew by 4.8% year-on-year, marking its fastest expansion since the first quarter of 2024.

This rapid growth is sparking optimism at home and abroad, while also raising questions about sustainability, inflation, and long-term stability.

Breaking Down the Numbers

- GDP Growth: 4.8% YoY

- Fastest Since: Q1 2024

- Key Drivers: Strong exports, domestic demand, and government-backed credit expansion

This growth is particularly noteworthy considering Turkey’s recent struggles with high inflation, currency depreciation, and external debt pressures.

What’s Driving Turkey’s Economic Growth?

Several factors are fueling this impressive performance:

1. Strong Export Demand

- Turkey is a major exporter of textiles, automotive parts, and consumer goods.

- Rising demand from Europe and the Middle East has boosted foreign revenue.

2. Government Policies & Credit Support

- Ankara has implemented state-backed loan programs to encourage business investment.

- Infrastructure projects and housing support schemes have boosted construction and related industries.

3. Domestic Consumption

- Despite high inflation, consumer demand remains resilient.

- Tourism has also rebounded strongly, with millions visiting Turkey this year.

4. Favorable Demographics

- With a young and growing population, Turkey benefits from a large labor force and rising middle-class consumption.

Challenges Behind the Growth

While the numbers look impressive, Turkey still faces structural challenges:

- High Inflation

- Inflation has been in double digits, eroding household purchasing power.

- Prices for essentials like food and energy remain high.

- Weak Turkish Lira

- The currency has lost significant value against the dollar and euro.

- Import costs remain high, impacting businesses.

- Debt Pressures

- External borrowing leaves Turkey vulnerable to global financial shocks.

- Rising U.S. interest rates make foreign debt costlier.

- Policy Concerns

- Critics argue that heavy government intervention creates short-term boosts but risks long-term imbalances.

How Does This Growth Affect Ordinary Citizens?

For the average Turkish citizen, 4.8% growth is both good news and a mixed blessing:

- Positive:

- More jobs, especially in construction, tourism, and exports.

- Rising wages in some industries.

- Stronger business activity brings new opportunities.

- Challenges:

- Inflation keeps eating into household budgets.

- Imported goods (electronics, fuel) remain expensive due to the weak lira.

It’s like being on a fast-moving train—the speed is exciting, but passengers worry if the brakes will hold.

What Does This Mean for Investors?

- Opportunities in Growth Sectors

- Tourism, construction, and exports show strong potential.

- Real estate remains attractive, especially for foreign buyers seeking cheaper property due to the weak lira.

- Risks to Watch

- Inflation and currency volatility remain the biggest risks.

- Political uncertainty can impact foreign investment confidence.

- Global Perception

- Turkey’s growth makes it stand out in the region, attracting attention from investors seeking emerging market exposure.

Global Context: Why It Matters

- Turkey is the 19th largest economy in the world.

- It’s a strategic bridge between Europe and Asia, making its stability critical for trade routes.

- A strong Turkey boosts regional supply chains but also raises geopolitical questions due to its ties with both the West and East.

Key Takeaway: Growth with Caution

Turkey’s 4.8% YoY growth is a remarkable achievement, but it comes with caveats:

- Short-term wins driven by exports and credit expansion are impressive.

- Long-term challenges like inflation and currency stability remain unsolved.

A Balancing Act Ahead

Turkey’s latest growth figures show an economy full of resilience and energy, but also fragile foundations.

The path forward will depend on how effectively the government can tame inflation, stabilize the lira, and attract sustainable investment.

For now, Turkey stands as a reminder that emerging economies can surprise the world—if they can manage the balancing act.

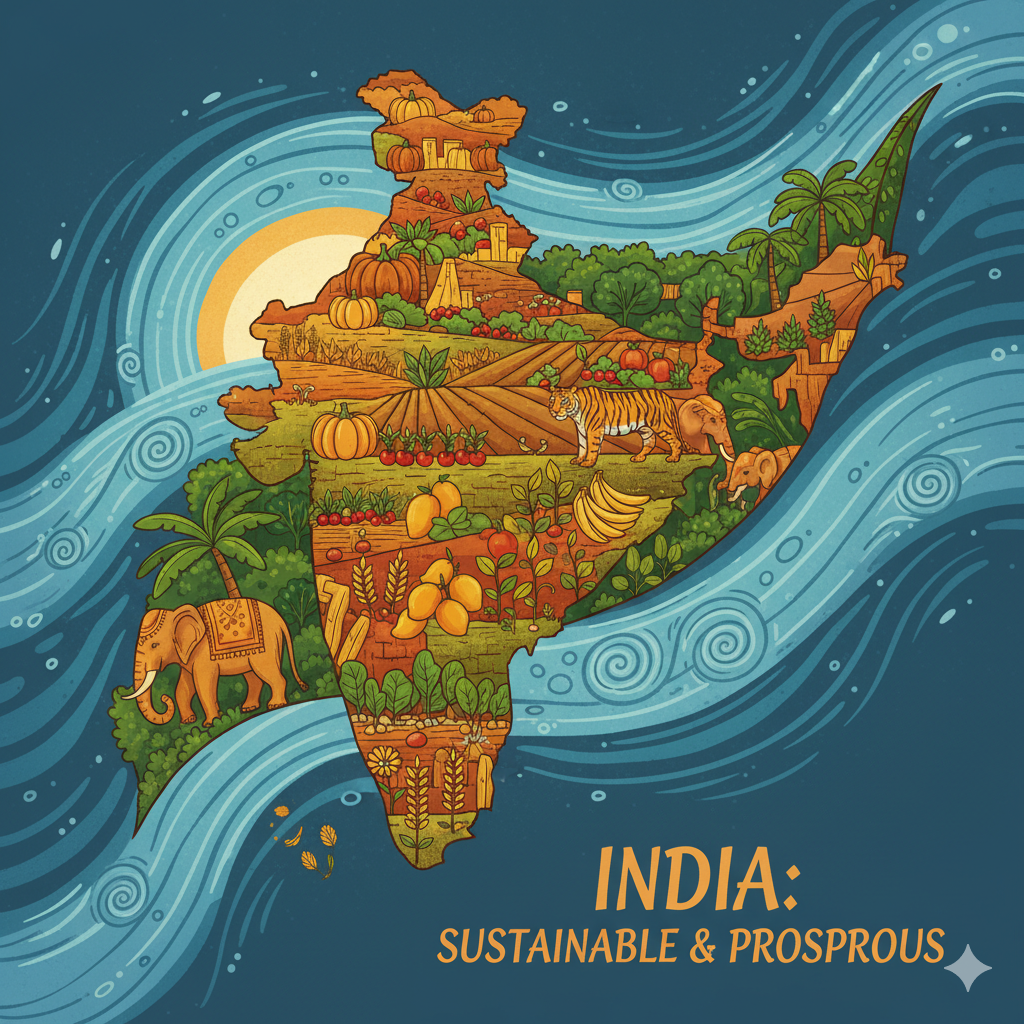

- Vegetarian Diet: A Sustainable Path to Animal Welfare in India

- Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

- Genetic Engineering for Wildlife: Reviving Extinct Species in India

- Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

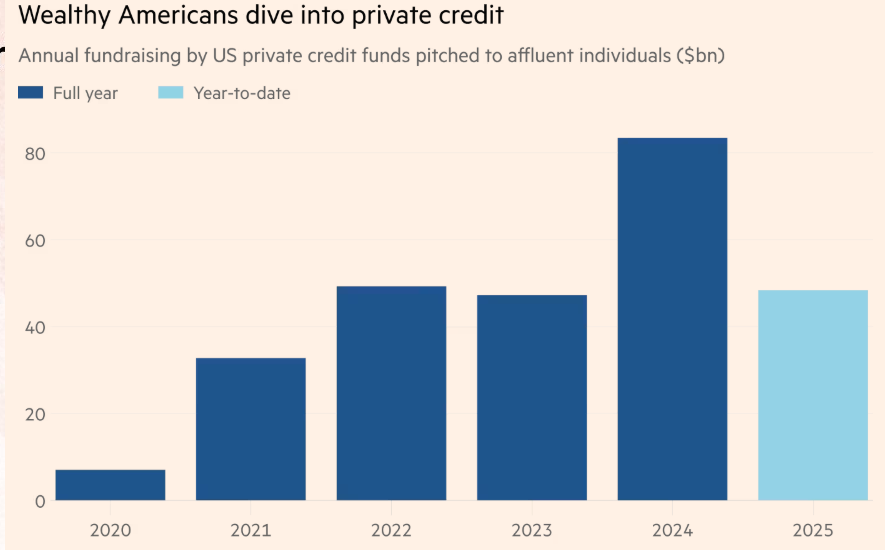

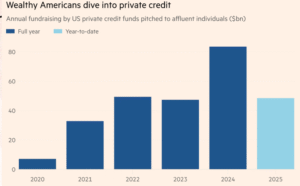

- Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Check Out Our More Content:-

Vegetarian Diet: A Sustainable Path to Animal Welfare in India

Vegetarian diet in India is renowned for its large vegetarian population, but meat consumption is…

Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

Supreme Court Verdict Brings Spotlight on Vantara and Vantara Government Project The Supreme Court of…

Genetic Engineering for Wildlife: Reviving Extinct Species in India

Introduction: The Promise of De-Extinction Imagine hearing a wolf’s howl never heard for 12,000 years….

Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

Introduction In August 2025, Punjab faced its most devastating floods in nearly four decades, as…

Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Introduction: The Silent Shift in American Wealth For decades, wealthy Americans poured money into stocks,…

India Blocks Azerbaijan’s Bid for Full Membership in the SCO: What It Means for Regional Politics

Introduction: A Diplomatic Roadblock The Shanghai Cooperation Organisation (SCO)—a powerful Eurasian political, economic, and security…