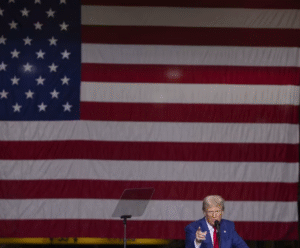

Trump Signs ‘One Big Beautiful Bill’ into Law During Patriotic July 4 Celebration

In a grand celebration on Independence Day, President Donald Trump signed into law his ambitious and controversial “One Big Beautiful Bill Act” (OBBBA), framing it as a landmark achievement of his second term. The ceremony, held on the White House South Lawn, was filled with national pride and spectacle—military flyovers, a rousing rendition of the national anthem, and fireworks lighting up the evening sky. Surrounded by top Republican lawmakers and supporters, Trump called the moment “the greatest victory yet” of his second administration.

While the celebrations painted a patriotic picture, the legislation itself has sparked intense debate. The bill, over 1,200 pages long, is packed with sweeping tax cuts, major spending shifts, and policy changes that will have far-reaching implications across American society.

What’s Inside the ‘One Big Beautiful Bill’?

The OBBBA is essentially a policy package reflecting Trump’s core campaign promises from 2020 and beyond, stitched into one comprehensive law. Here’s a breakdown of some of its most significant elements:

Historic Tax Cuts for Middle- and Working-Class Americans

The bill permanently extends the individual tax rate cuts that Congress passed in 2017 under the Tax Cuts and Jobs Act and had scheduled to expire in 2025.. According to the White House, this move represents “the largest middle- and working-class tax cut in U.S. history.”

Among the most notable tax reforms:

- No federal income tax on tips, overtime pay, or car loan interest. This alone, says the administration, could result in average annual savings of $1,750 for overtime workers and around $1,700 for tipped workers like waiters and bartenders.

- Expansion and permanency of the 199A small business deduction—business owners can now deduct 23% of their income under this provision.

- Increased Child Tax Credit and maintenance of the doubled standard deduction introduced in 2017, which benefits roughly 91% of American households.

‘Trump Accounts’ for Families in One Big Beautiful Bill

Furthermore, the bill introduces a new initiative called “Trump Accounts”—specialized savings vehicles that allow parents to contribute tax-deferred funds for their children’s future. These accounts can be used for education, first-time home purchases, or even entrepreneurial ventures, giving families more control over long-term financial planning.

Dramatic Shifts in Federal Spending

The OBBBA commits to a significant realignment in federal priorities. Defense and immigration enforcement see major boosts:

- $150 billion allocated to defense spending—a major increase aimed at modernizing the military and expanding cybersecurity capabilities.

- $150 billion dedicated to border enforcement and deportations. The bill increases ICE (Immigration and Customs Enforcement-US) funding from $10 billion today to over $100 billion by 2029, making it one of its most contentious points.

At the same time, there are substantial rollbacks…

- In contrast, the bill phases out clean energy tax credits introduced during President Biden’s tenure under the Inflation Reduction Act. These include tax incentives for electric vehicles, solar energy installations, and home energy-efficiency upgrades.

- Reforms to Medicaid, introducing work requirements for certain recipients. Supporters claim this promotes self-reliance, while critics argue it could leave millions vulnerable.

New Taxes in Unexpected Places in One Big Beautiful Bill

Interestingly, despite focusing heavily on tax cuts, the bill introduces a few targeted tax increases:

- A new 1% tax on remittances—money sent from U.S.-based workers to family members abroad. The administration claims this will help fund border security.

- Increased taxes on large university endowments, targeting elite institutions with multi-billion-dollar funds. Trump described these endowments as “hoarded wealth” and urged their direct use for public benefit.

Political Reactions: A Deep Divide

As expected, the bill passed Congress along strict party lines, with Republicans unanimously backing it and Democrats uniformly opposing. Speaker of the House Mike Johnson hailed it as “a rebirth of American economic freedom,” while Senate Minority Leader Chuck Schumer called it “a gift to the wealthy, wrapped in a firework show.”

As a result, Democratic lawmakers have particularly criticized the projected fiscal impact. According to a recent analysis by the Committee for a Responsible Federal Budget, the OBBBA will add more than $4.1 trillion to the national debt over the next decade. Critics argue this undermines the fiscal responsibility Republicans often claim to champion.

Public Response and Future Outlook

As expected, public response has been mixed and deeply divided. Among Trump’s base, the bill is being hailed as a historic win. “This is why we voted for him,” said Mark Sanders, a small business owner from Ohio. “We finally get to keep more of what we earn.”

On the other hand, progressive advocacy groups and economists warn of long-term consequences. “Slashing taxes while ballooning defense and ICE budgets is not sustainable,” said Dr. Linda Qureshi, a policy analyst at the Brookings Institution. “And the rollback of clean energy incentives is a step backward in the climate fight.”

Despite the controversy, one thing is clear: the ‘One Big Beautiful Bill Act’ is now law, and its effects will ripple through every sector of American life for years to come. As the 2026 midterms approach, both parties are likely to use the legislation as a central campaign issue, either as a crowning achievement or a cautionary tale.

For now, Trump has his victory—and he’s celebrating it in true Trump fashion: big, bold, and unrelentingly controversial.

For More Resources…

1.https://english.news.cn/northamerica/20250705/6830081dd8824254826bcd99cbd3be3b/c.html

For AI Info’s:-

1.https://rashtraalerttimes.com/from-sci-fi-to-reality-what-is-ai-and-how-its-shaping-our-future/