A Growing Financial Burden

For many American families, debt is as common as rent, groceries, or utility bills. From mortgages to car loans, student loans to credit cards, debt has become woven into everyday life.

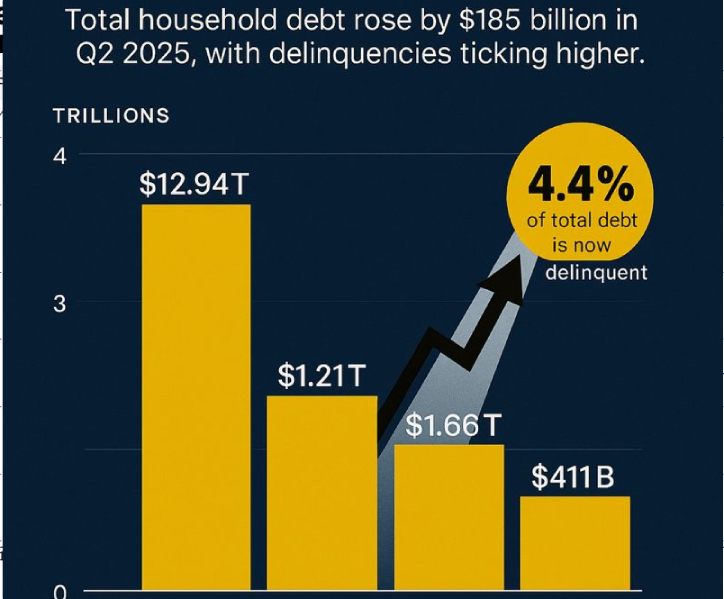

But in the latest quarter, total U.S. household debt hit $18.39 trillion, a new all-time high.

This number is not just a statistic—it reflects the rising cost of living, inflation pressures, and the financial juggling act millions of households face every day.

Breaking Down the $18.39 Trillion

So, what makes up this staggering figure? Here’s the composition of household debt:

- Mortgages: $12.4 trillion (largest portion)

- Student Loans: $1.6 trillion

- Auto Loans: $1.6 trillion

- Credit Card Debt: Over $1.3 trillion

- Other Consumer Loans: Personal loans, medical bills, etc.

Each of these categories has been climbing steadily, with credit card balances and auto loans seeing some of the sharpest increases.

Why Is Household Debt Rising So Fast?

Several factors are fueling this record-breaking surge:

1. Higher Interest Rates

- The Federal Reserve’s fight against inflation has raised borrowing costs.

- Mortgages, car loans, and credit card interest rates are at their highest levels in decades.

2. Rising Cost of Living

- Families are borrowing more just to cover everyday expenses—groceries, gas, healthcare.

- Wages haven’t kept pace with inflation, leading many to rely on credit cards.

3. Housing Market Pressures

- Home prices remain high, and mortgage debt continues to rise even as fewer people buy homes.

- Renters, too, are struggling, sometimes turning to loans to cover rent gaps.

4. Student Debt Resumption

- After the pandemic pause, student loan repayments resumed, adding strain to millions of households.

The Risks of Record Debt

This growing mountain of debt has serious implications for individuals and the economy:

For Families:

- Financial Stress: More income goes to interest payments instead of savings.

- Limited Flexibility: High debt reduces families’ ability to handle emergencies.

- Delayed Goals: Buying a home, starting a business, or saving for retirement gets postponed.

For the Economy:

- Slower Consumer Spending: When debt burdens rise, people cut back on shopping and leisure.

- Bank Risks: Rising defaults could shake lenders and the financial system.

- Recession Fears: Economists worry excessive debt may trigger a slowdown if households can’t keep up.

A Human Perspective: Debt as a Silent Weight

Imagine a family of four in Ohio. The parents have a mortgage, two car loans, credit card balances, and student loans from their college days. Every month, nearly 40% of their income goes to debt repayments.

This isn’t unusual. For many households, debt isn’t about luxury—it’s about survival. But it comes at the cost of peace of mind, future planning, and financial freedom.

Is All Debt Bad?

Not necessarily. Some debt can be considered “good debt”:

- A mortgage that builds home equity.

- A student loan that increases earning potential.

- A business loan that funds growth.

But the danger lies in “bad debt”—high-interest loans and credit card balances that don’t create long-term value.

Tips for Households Managing Debt

Here are practical steps families can take to manage rising debt:

1. Track Your Spending

- Use budgeting apps to see where your money is going. Awareness is the first step.

2. Prioritize High-Interest Debt

- Pay off credit card balances before focusing on lower-interest loans.

3. Refinance Where Possible

- If mortgage or auto rates drop, refinancing can ease monthly payments.

4. Build an Emergency Fund

- Even a small cushion reduces the need to rely on debt during unexpected expenses.

5. Seek Professional Advice

- Financial advisors or credit counseling agencies can help families restructure payments.

Broader Economic Outlook

Economists are divided on whether this record debt is a red flag or a manageable trend.

- Optimists argue that most households are still making payments, and strong employment supports debt servicing.

- Pessimists warn that high interest rates and slowing wage growth could lead to more defaults, particularly in credit cards and auto loans.

Analogy: Carrying a Heavy Backpack

Think of the U.S. economy as a hiker carrying a backpack. A little weight (debt) helps build strength, but too much can slow the hiker down or cause collapse. Right now, the backpack is heavier than ever, and whether the hiker can keep moving depends on stamina (income growth) and smart pacing (spending habits).

A Warning and a Call to Action

The record $18.39 trillion in household debt is both a symptom and a warning. It shows how much families rely on borrowing to survive in today’s economy, but it also signals rising risks if wages and opportunities don’t catch up.

For households, the takeaway is clear: take control of your debt before it takes control of you. For policymakers, it’s a reminder that fighting inflation is not just about numbers—it’s about the lives and struggles of ordinary people.

Check Out More U.S Content:-

https://rashtraalerttimes.com/trump-responds-to-death-rumors-never-felt-better-in-my-life/

Check Out Our More Content:-

- Vegetarian Diet: A Sustainable Path to Animal Welfare in India

- Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

- Genetic Engineering for Wildlife: Reviving Extinct Species in India

- Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

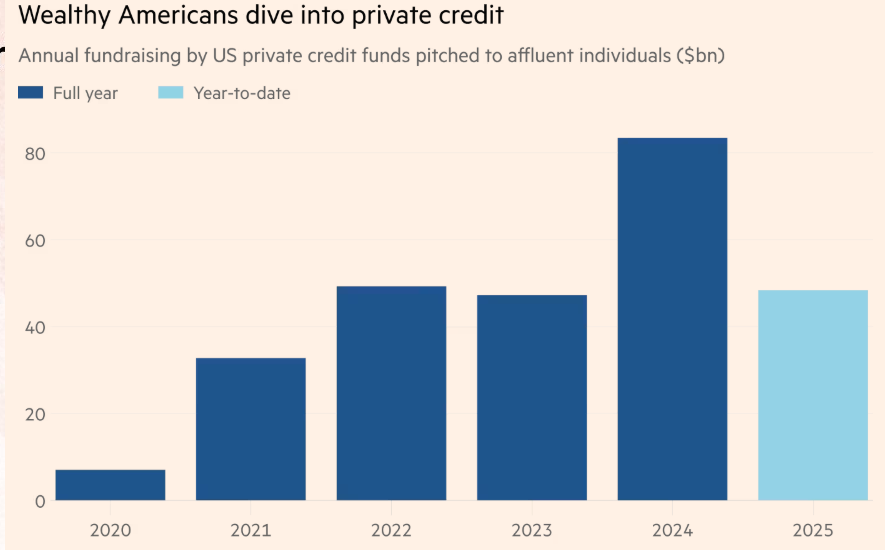

- Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Vegetarian Diet: A Sustainable Path to Animal Welfare in India

Vegetarian diet in India is renowned for its large vegetarian population, but meat consumption is…

Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

Supreme Court Verdict Brings Spotlight on Vantara and Vantara Government Project The Supreme Court of…

Genetic Engineering for Wildlife: Reviving Extinct Species in India

Introduction: The Promise of De-Extinction Imagine hearing a wolf’s howl never heard for 12,000 years….

Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

Introduction In August 2025, Punjab faced its most devastating floods in nearly four decades, as…

Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Introduction: The Silent Shift in American Wealth For decades, wealthy Americans poured money into stocks,…

India Blocks Azerbaijan’s Bid for Full Membership in the SCO: What It Means for Regional Politics

Introduction: A Diplomatic Roadblock The Shanghai Cooperation Organisation (SCO)—a powerful Eurasian political, economic, and security…

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.