Introduction: Calm Before the Storm in Global Markets

Financial markets often reflect a mix of hope, fear, and strategy. On Sunday night, U.S. stock futures edged higher, while the CBOE Volatility Index (VIX)—known as Wall Street’s “fear gauge”—slipped lower.

At first glance, this might look like a small technical move. But in reality, it’s a signal of investor sentiment ahead of a crucial week packed with economic data, earnings reports, and central bank updates. The big question is: should investors see this as a green light for optimism, or a warning of hidden risks?

What Happened in Sunday Night Trading?

Here’s the snapshot of the futures market on Sunday evening:

- Dow Jones Industrial Average Futures: Up slightly, showing cautious optimism.

- S&P 500 Futures: Rose modestly, indicating confidence in large-cap stocks.

- Nasdaq Futures: Also edged higher, supported by tech strength.

- VIX Index: Fell, suggesting reduced short-term market fear.

This combination—rising futures and a falling VIX—usually hints at a risk-on attitude, meaning investors are more comfortable holding stocks.

Why Is the VIX Important?

The VIX (Volatility Index) is often called the fear gauge because it measures expected volatility in the S&P 500 over the next 30 days.

- A high VIX means investors expect turbulence (fear).

- A low VIX means investors expect stability (calm).

Think of it like checking the weather before a long road trip. A forecast of storms makes drivers nervous; clear skies make them confident.

With the VIX slipping, investors appear to believe the upcoming week won’t bring major surprises—at least not yet.

The Week Ahead: What’s Driving Investor Sentiment?

1. Economic Data Releases

- Jobs Report: Investors will be watching U.S. employment numbers closely. A strong jobs report signals growth but may push the Fed to keep rates higher.

- Inflation Data: Any spike in consumer prices could reignite fears of sticky inflation.

2. Earnings Season

- Major companies are set to release quarterly results this week. Tech giants, banks, and retail stocks will drive momentum.

- Strong earnings could fuel rallies, while weak results might trigger volatility.

3. Federal Reserve Updates

- Traders are scanning for hints on the Fed’s next interest rate move.

- Even a small shift in tone from policymakers can cause big market swings.

4. Global Factors

- Ongoing geopolitical tensions (Russia-Ukraine, China-U.S. trade) continue to hover in the background.

- Oil price movements may affect energy stocks and inflation expectations.

Why Are Stock Futures Rising?

Several factors explain the Sunday night optimism:

- Cooling Inflation Trends: Recent reports suggest price pressures are easing.

- Resilient Consumer Spending: U.S. shoppers continue to spend despite higher interest rates.

- Earnings Optimism: Analysts expect stronger-than-feared results from tech and consumer companies.

- Fed Pause Hopes: Markets are betting the Fed might hold rates steady rather than hike aggressively.

Put simply, investors are betting on a soft landing for the economy rather than a deep recession.

What Should Investors Watch Closely?

1. Market Breadth

It’s not enough for just a handful of tech stocks to rise. Broader participation across industries signals real strength.

2. Bond Yields

Rising Treasury yields could weigh on equities, especially growth stocks.

3. VIX Levels

If the VIX suddenly spikes midweek, it means investors are bracing for turbulence.

4. Sector Rotation

Watch whether money is flowing into defensive sectors (healthcare, utilities) or riskier areas (tech, small caps). This reveals investor confidence.

Lessons for Everyday Investors

1. Don’t Get Fooled by Calm Markets

Just because futures rise on Sunday night doesn’t mean the week will stay calm. Markets can flip quickly when new data arrives.

2. Diversify Your Portfolio

Putting all your money in one sector is risky. Balance between stocks, bonds, and alternative assets to ride out volatility.

3. Keep an Eye on the Fed

The Federal Reserve’s stance on interest rates remains the biggest driver of market direction. Follow Fed speeches and updates.

4. Use the VIX as a Guide, Not a Crystal Ball

The VIX gives clues about investor sentiment, but it’s not always predictive. Think of it as an early warning system rather than a guarantee.

A Small Story: How Investors React to Calm Markets

Imagine a group of sailors heading into open seas. The weather forecast looks calm, so they relax, open their sails wide, and enjoy smooth waters. But seasoned sailors know the sky can change quickly. Markets are the same—Sunday night optimism is great, but investors need to stay alert for storms ahead.

Optimism with Caution

The rise in stock futures and the dip in the VIX on Sunday night point to growing investor confidence. But with a packed week of jobs data, inflation reports, and earnings announcements, this calm may not last.

For traders and long-term investors alike, the key is balance: enjoy the market’s positive momentum, but stay prepared for surprises.

Check Out Our Latest posts:-

Vegetarian Diet: A Sustainable Path to Animal Welfare in India

Vegetarian diet in India is renowned for its large vegetarian population, but meat consumption is ri…

Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

Supreme Court Verdict Brings Spotlight on Vantara and Vantara Government Project The Supreme Court o…

Genetic Engineering for Wildlife: Reviving Extinct Species in India

Introduction: The Promise of De-Extinction Imagine hearing a wolf’s howl never heard for 12,000 year…

Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

Introduction In August 2025, Punjab faced its most devastating floods in nearly four decades, as ove…

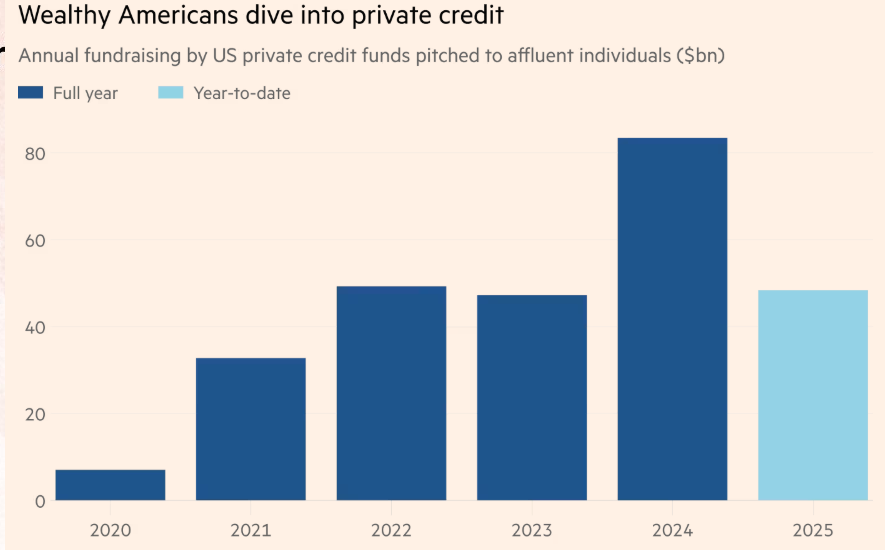

Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Introduction: The Silent Shift in American Wealth For decades, wealthy Americans poured money into s…

India Blocks Azerbaijan’s Bid for Full Membership in the SCO: What It Means for Regional Politics

Introduction: A Diplomatic Roadblock The Shanghai Cooperation Organisation (SCO)—a powerful Eurasian…

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

xn88 chính là địa điểm dừng chân lý tưởng, thiên đường giải trí xanh chín đáp ứng đầy đủ tiêu chí anh em không nên bỏ qua. Với sự đa dạng, sức hút và sự cam kết về chất lượng, nhà cái hàng đầu Fun 88 hứa hẹn mang tới cho bạn những trải nghiệm đỉnh cao tuyệt vời cùng cơ hội làm giàu nhanh chóng. TONY02-25O