Introduction: Japan’s Bold Bet on Bitcoin

Bitcoin has often been described as digital gold—a hedge against inflation, a store of value, and a long-term bet on decentralized finance. While most governments remain cautious, some companies are going all in.

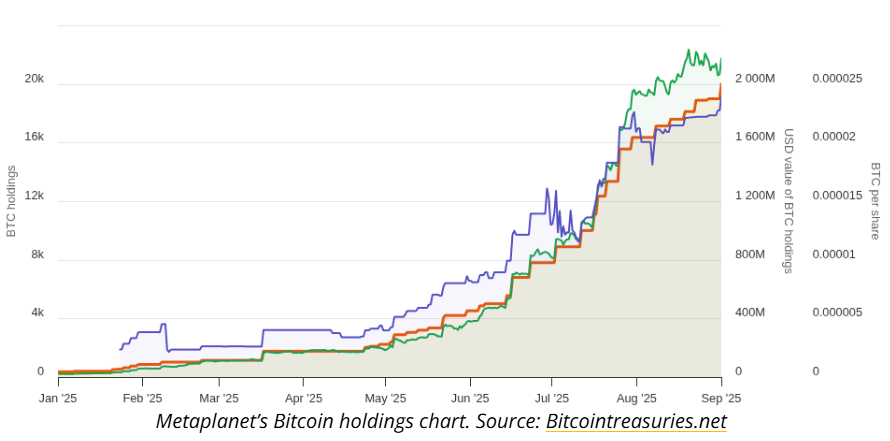

One of the boldest players? Metaplanet, a Japanese investment firm that has just added 1,009 Bitcoin (BTC) worth $110 million, bringing its total holdings to 20,000 BTC (around $2.15 billion).

This move cements Metaplanet as Japan’s version of MicroStrategy, the U.S. firm famous for pioneering corporate Bitcoin adoption.

Who Is Metaplanet?

- Metaplanet is a Tokyo-based publicly traded firm.

- Once focused on hospitality, it pivoted toward Bitcoin-focused financial strategy in 2023.

- Its goal is to make Bitcoin the core reserve asset on its balance sheet.

The company’s strategy reflects a broader shift in Japan, where traditional investment is blending with crypto enthusiasm.

The New Purchase: Why 1,009 BTC Matters

Buying 1,009 BTC at once may seem like a drop in the bucket for Bitcoin’s trillion-dollar market cap, but it signals key trends:

- Institutional Confidence

- Large firms buying Bitcoin show rising trust in crypto as a long-term store of value.

- Accumulation Strategy

- Like MicroStrategy, Metaplanet isn’t speculating short-term—it’s stacking Bitcoin consistently.

- Market Impact

- Big corporate purchases often drive positive sentiment and attract retail investors.

Why Is Metaplanet So Bullish on Bitcoin?

Several reasons explain the company’s aggressive strategy:

1. Hedge Against Yen Weakness

- The Japanese yen has struggled against the U.S. dollar.

- Bitcoin offers a way to diversify reserves away from fiat currency risk.

2. Global Trend of Institutional Adoption

- From Tesla to MicroStrategy, major companies are holding BTC.

- Metaplanet is putting Japan on the map as part of this global wave.

3. Store of Value in Uncertain Times

- Inflation, geopolitical tensions, and debt concerns make Bitcoin appealing as a non-sovereign asset.

4. Appeal to Shareholders

- By branding itself as Japan’s Bitcoin leader, Metaplanet attracts crypto-friendly investors.

How Big Is 20,000 BTC?

Let’s put it in perspective:

- At 20,000 BTC, Metaplanet now holds around 0.1% of total Bitcoin supply (21 million BTC maximum).

- That’s comparable to some of the largest institutional holdings in the world.

- At today’s prices, it’s worth about $2.15 billion.

For a Japanese company, this is a massive financial pivot.

Comparison: Metaplanet vs. MicroStrategy

- MicroStrategy (U.S.): Holds over 200,000 BTC worth ~$22 billion.

- Metaplanet (Japan): Holds 20,000 BTC worth ~$2.15 billion.

While smaller, Metaplanet is following the same Bitcoin-first treasury strategy, earning it the nickname “Japan’s MicroStrategy.”

Critics’ Concerns

Not everyone is cheering. Analysts raise concerns:

- Volatility Risk

- Bitcoin’s price swings could wipe out billions in value.

- If BTC falls sharply, Metaplanet’s balance sheet takes a hit.

- Regulatory Uncertainty

- Japan has strong crypto regulations, but global policy remains inconsistent.

- A crackdown could hurt Metaplanet’s strategy.

- Overexposure

- With so much wealth tied to one asset, the company risks becoming too dependent on Bitcoin.

Supporters’ Argument

On the flip side, advocates say:

- First-Mover Advantage: By adopting Bitcoin early, Metaplanet secures long-term value.

- Institutional Momentum: As more companies and ETFs adopt BTC, prices could stabilize at higher levels.

- Shareholder Value: Investors seeking Bitcoin exposure can buy Metaplanet stock instead of BTC directly.

What This Means for Crypto Investors

For retail and institutional investors, Metaplanet’s move sends a signal:

- Confidence in Bitcoin’s Future – Big players aren’t backing away; they’re doubling down.

- Institutional FOMO – As more firms add BTC, others may feel pressure to join in.

- Japan’s Role in Crypto – With Metaplanet leading, Japan may emerge as a crypto-friendly hub in Asia.

Small Analogy: Stacking Gold Bricks

Think of Metaplanet as a modern treasure hunter. Instead of gold bricks, they’re stacking Bitcoin—one block at a time. Over time, this treasure chest grows, not just in size but in symbolic power.

Japan’s Bold Crypto Statement

Metaplanet’s purchase of 1,009 BTC, raising its holdings to 20,000 BTC ($2.15B), is more than a financial move—it’s a statement.

It says: Bitcoin is not just an experiment, but a strategic asset worth holding long term.

As the world debates crypto regulation and adoption, Metaplanet’s bold bet may inspire more companies—both in Japan and globally—to follow the same path.

- Vegetarian Diet: A Sustainable Path to Animal Welfare in India

- Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

- Genetic Engineering for Wildlife: Reviving Extinct Species in India

- Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

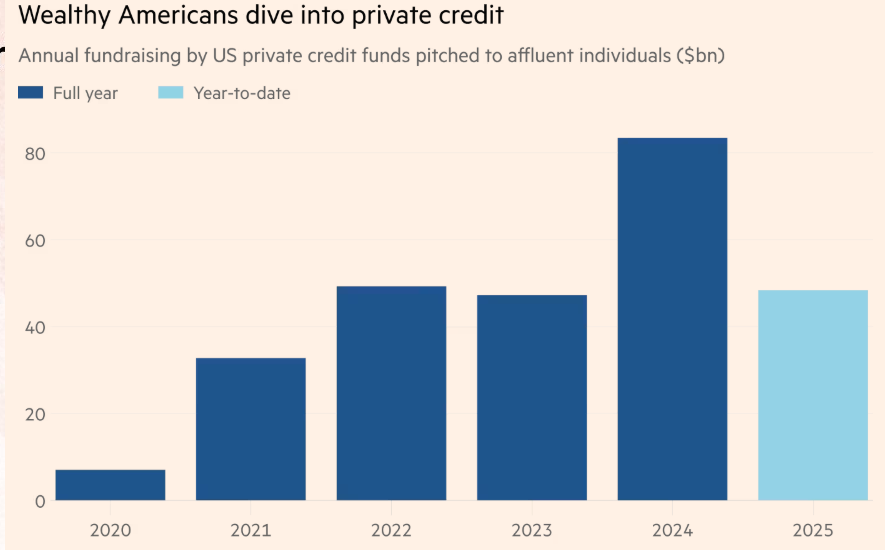

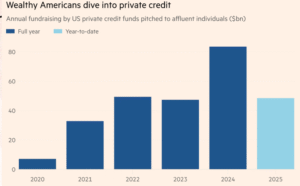

- Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Check Out more Content:-

Vegetarian Diet: A Sustainable Path to Animal Welfare in India

Vegetarian diet in India is renowned for its large vegetarian population, but meat consumption is…

Vantara Case Sparks Debate: Should Government Lead Wildlife Welfare Projects Across India?

Supreme Court Verdict Brings Spotlight on Vantara and Vantara Government Project The Supreme Court of…

Genetic Engineering for Wildlife: Reviving Extinct Species in India

Introduction: The Promise of De-Extinction Imagine hearing a wolf’s howl never heard for 12,000 years….

Punjab Floods 2025: Latest Impact, Causes & Urgent Lessons

Introduction In August 2025, Punjab faced its most devastating floods in nearly four decades, as…

Wealthy Americans Pump Record Sums Into Private Credit Funds – A New Era of Alternative Investing

Introduction: The Silent Shift in American Wealth For decades, wealthy Americans poured money into stocks,…

India Blocks Azerbaijan’s Bid for Full Membership in the SCO: What It Means for Regional Politics

Introduction: A Diplomatic Roadblock The Shanghai Cooperation Organisation (SCO)—a powerful Eurasian political, economic, and security…

Bạn có thể đặt lịch nhắc nhở khuyến mãi tại xn88 – hệ thống sẽ gửi thông báo trước 1 giờ khi có chương trình mới bắt đầu, đảm bảo bạn không bỏ lỡ bất kỳ deal hot nào. TONY02-25O

Người chơi sẽ được hoàn lại,25% tổng số tiền đặt cược mỗi ngày, không giới hạn tối đa. 188v – Link Vào Trang Chủ 188BET Chính Thức & Uy Tín Nhất 2024 Chính sách này áp dụng cho tất cả các loại hình cá cược, bao gồm Thể Thao và Quay Số (Saba), giúp giảm thiểu rủi ro và tối đa hóa lợi nhuận. TONY02-25O